What is this Islamic bank?

Muslims are a community that has been closely associated with the trade since time immemorial. Trade is something that is mixed with their blood, and they have an unbreakable bond with trade. There is another factor that contributes to this. This is because in Islam, Muslims are forbidden to take interest and instead trade and allow profiteering. The reason for this is that the religion states that interest is an unjust gain and that it primarily affects the division of society into classes, creating extraordinary economic wealth in human society. Looking at modern economic patterns, you can see the impact of the interest factor on economic patterns. That is why Muslims are forbidden to pay interest and those who engage in it are greatly disgusted. The world market has undergone rapid changes over the decades.

With the advancement of technology, the Muslim-majority states also had to adapt to the modern changes taking place in the world market. There they had to deal regularly with interest-based banks as a profit, and as it did not conform to their Islamic financial principles, they decided to start their own banking system that did not use interest.

Thus, in 1974, the Islamic Development Bank was established as the world's first Islamic bank to make a profit from interest-free Islamic financial systems. Since then, the leading banks in Islamic finance have gained a significant foothold in the world market. The World Bank has also set up a Global Financial Development Development Center (GIFDC) under the auspices of the World Bank, which conducts and conducts research related to Islamic finance.

The industry has also grown to include the world-renowned AAOIFI and IFSB Accounting Standards.

What are these Islamic financial systems?

Islamic financial systems were trading systems that could be seen in the society of the time of the Prophet Muhammad. He despised interest and valued fair trade. For example, if you mention a few major Islamic financial methods

* Murabaha system

Indicate the purchase price of the item and the profit to be charged on the sale and declare the sale to the buyer.

* Musawwama system

Buying an item and selling it at a profit (normal sales)

* Mudharaba system

One party invests capital and the other directs the business.

* Musharaka system (joint trade)

Starting a business with a few people investing a lot of capital.

* Salam (advance payment)

Booking and booking before purchasing the item

* Istisna (Contracting)

Taking money on a contract basis for the purpose of providing a certain product or service.

* Ijara (for rent)

Providing goods and services on hire basis

(There are other financial methods associated with this and these, for example financial methods developed within the Islamic framework such as "Diminishing Musharaka". Details will be published in a separate article later)

Can a bank operate without charging interest?

The best example to prove that interest income is not essential for running a bank is the establishment of an Islamic banking system in the world. In this way, the Islamic banking system, simply put, they operate by raising large sum of money from customers, setting up capital and investing them in various businesses. In this way, the bank makes a profit by investing in small and medium enterprises, ensuring that interest rates are not mixed according to an Islamic framework of financing under various names. Part of the net profit is paid to depositors who have deposited cash. Typically in a bank, the money collected from the depositors is paid to the depositors at a certain percentage of the interest income lent to other persons through various loan schemes.

In the same way, you may be wondering whether Islamic banks lend in the same way that a normal bank lends to individuals. The direct answer is no. If you want to start a business with the help of an Islamic bank, the first thing you need to do is submit your business plan to the bank. The bank then invests the depositors' money in your business. The bank will then provide you with a payment method designed to repay the amount invested and the profit due to the bank on that money. The profits are divided between the bank and the depositors according to the agreed percentage. In this way, various Islamic banks operate within the Islamic financial framework (interest free) and provide various services to their customers under different names.

What happens to the profit earned by Islamic banks?

The Banking Act No. 30 of 1988, which governs the banking of Sri Lanka, was amended on December 10, 2005 to allow for Islamic banking. Thus, Amana Bank became the first Islamic bank in Sri Lanka. Profitable Islamic banks in Sri Lanka divide their profits between depositors and the bank after levying income tax due to the country in accordance with the statutory monetary law of Sri Lanka. In Sri Lanka, Islamic banks do not have the space to start and operate as they please. Like other commercial banks, Islamic banks are regulated by the Central Bank of Sri Lanka.

Is Islamic banking forbidden to pagans?

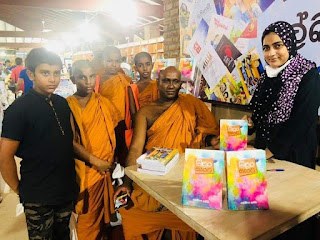

Due to the 'Islamic' name of Islamic banks, some people interpret this as a banking system exclusive for Muslims. But the truth is that it is not. Any Sri Lankan who opens an account with an Islamic bank in Sri Lanka can avail any of its financial services. Even today, many non-Muslims maintain their accounts in Islamic banks and run their businesses successfully.

Are Muslims the only ones investing in Islamic banks?

That is a misconception. In the current Colombo Stock Exchange, non-Muslims hold large stocks in Islamic banks in Sri Lanka. The misconception that the Islamic Bank's profits from its operations are shared among all its shareholders eliminates the misconception that Islamic Bank's profits are shared only among Muslims. Even today, non-Muslims make a profit by investing their money in an Islamic bank.

Why an Islamic bank for Muslims?

As mentioned above, Muslims are not entitled to interest on any transaction. Instead, the profits they make from the business are religiously endorsed. Any people who live according to the Dhamma live their lives according to the Dhamma by performing all the activities of their life. In the same way, Muslims have set up financial systems that suit Muslims in financial matters. It does no harm to another community. The only difference is that when they do interest-based transactions, they only engage in profit-oriented trading methods. With the establishment of all types of banks, every Sri Lankan has the opportunity to invest in any banking system of their choice.

Is it not possible to start an Islamic bank without the name 'Islamic'?

It is possible. It is not necessary to name a bank that operates under an Islamic financial framework as Islamic Bank. But in a competitive business world, bankers use the name "Islamic Bank" to promote their business in order to get Muslim deposits to their banks. Some licensed commercial banks (both interest-based banks) in Sri Lanka also maintain separate interest-free Islamic banking units (Islamic Windows) to grow their businesses. Their purpose is nothing more than to provide bank financing for those who do not wish to use interest.

M.N.M.Minaz

BA (Special) Islamic Banking and Finance (UG)

South Eastern University of Sri Lanka

Comments

Post a Comment